-

Notifications

You must be signed in to change notification settings - Fork 2

Description

dap: 8

project name: CDx

main site: cdxproject.com

author: Andrew Young <andrew@cdxproject.com>, Jake Hannah <jake@cdxproject.com>, Julian Wilson (@mrwillis)

discussions-to: https://t.me/CDxProject

status: Draft

created: 2018-10-01

Simple Summary

CDx is a permissionless protocol that enables anyone to issue, trade, and resolve tokenized credit default swaps on Ethereum.

Abstract

CDx is a protocol that enables the issuance, trading, and resolution of tokenized credit default swaps on the Ethereum blockchain. The protocol serves as an open standard for participants to both price and trade different types of credit risk in a fully trustless, peer-to-peer setting. It follows the lead of 0x in utilizing off-chain relaying of orders and on-chain settlement of contracts. The protocol handles swap resolution through a decentralized determinations committee that is incentivized to act honestly through the staking of protocol tokens. Liquidity is incentivized at the protocol level through a novel proof-of-liquidity mechanism that rewards active participants. Rehypothecation enables swap sellers to partially collateralize swaps while still ensuring that buyers are guaranteed payment. The first use case for CDx will be exchange hacks and Dharma issued tokenized debt, but the protocol will be expanded to include credit default swaps on crypto stablecoins, staking pools, etc. Any type of credit risk where there is a possibility of a counterparty failing to repay an obligation, CDx swaps have potential utility. We imagine a world where all $10 trillion worth of traditional credit swaps are tokenized, driving large increases in efficiency, access, and transparency into of capital markets.

Resources

- Site - cdxproject.com

- Code - To be released in October

- Whitepaper: https://cdxproject.com/assets/resources/cdx-whitepaper.pdf

Motivation

The ability to price and trade credit risk is an essential component of modern risk management. We believe the DeFi ecosystem will benefit from having an open protocol that is focused on optimizing the transfer of credit risk. The traditional CDS asset class is opaque and inaccessible, and yet has a staggering $10 trillion of outstanding notional. By creating an open protocol built on Ethereum, CDx plans to make the asset class accessible to all members of society and drive down the traditionally high transaction costs.

Like other DeFi protocols, CDx is open source infrastructure that can be used to create new businesses or be integrated with other protocols to create entirely new types of assets. The following are some possible integrations:

- Integration with Dharma protocol enabling participants to create and transact CDS that reference tokenized debt positions. For example, a lender holding different Dharma debt tokens could hedge the risk of borrower default using a CDx CDS.

- Integration with Set protocol enabling participants to bundle their CDS positions into new assets. For example, a relayer could package swaps into a CDO and sell off different tranched risk exposures to investors based on their risk preferences.

- Integration with 0x or Dharma relayers that wish to host primary or secondary trading of these swaps.

CDx plans to continuously roll out new types of markets that swaps can reference to drive new integrations. For example, we’re planning to release swaps that reference stablecoins so that participants can buy insurance on their stablecoin collapsing.

Specification

Whitepaper: https://cdxproject.com/assets/resources/cdx-whitepaper.pdf

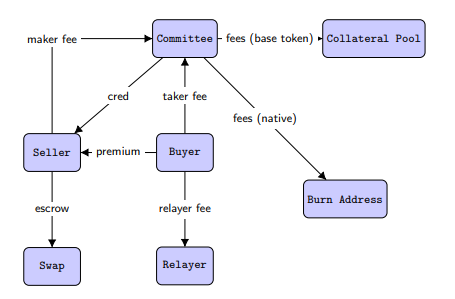

Order flow visualization:

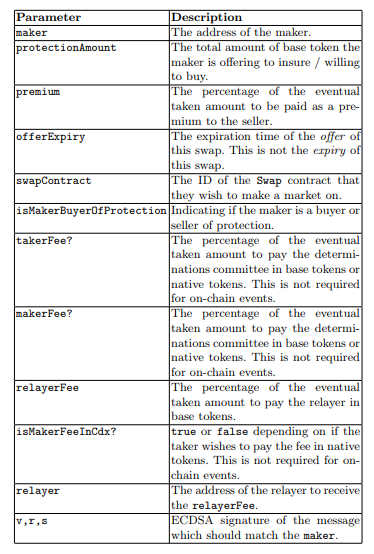

Sample swap order:

Rationale

Trading

We adapted the off-chain order book and on-chain settlement idea from 0x and applied it to CDx as we felt like it produces the most efficient trading dynamics. We also considered an order-book that was strictly on-chain but we felt that the 0x style is better in all cases aside from the most decentralized applications where having an off-chain relayer is not acceptable.

An automated market making (AMM) strategy and a dutch auction were also considered to incentivize liquidity in the protocol, especially on the sell-side and early in the network’s life. An AMM strategy might very well work in the CDx protocol but there are some trade-offs that such a strategy incurs. First, it is well known fact that an AMM is economically inefficient compared to standard trading. This can cause problems if the protocol ends up having significant trading volume in the future as we don’t want to bias early liquidity over long-term price efficiency at the protocol layer. We believe there are other effective ways we can incentivize liquidity both on-chain and off-chain. The other reason we didn’t go with this technique is that an AMM is not trivial to implement in Solidity and hence it would add complexity to an already complex protocol.

A dutch auction actually has some merit and we will consider using an auction-type structure in a future iteration of the protocol. One idea is to split up each market’s lifespan, starting with a dutch auction phase and then moving to a free-trading phase. The dutch auction does a great job of incentivizing liquidity by removing the burden of pricing the swaps on the sellers, which can be difficult at times. After the auction is over, buyers and sellers could then trade freely until the expiry of the market.

Voting

For on-chain credit events, such as those referencing Dharma debt or stablecoins, a swap resolution system is not required as there are on-chain hooks that can provide this information. However, swap resolution for off-chain credit events is more involved and essentially involves creating a decentralized oracle.

In general, we think there is a fundamental trade-off between accuracy and simplicity when it comes to designing such a system in the context of generalized prediction markets; anything past a well-incentivized token-weighted vote has significant diminishing returns, especially in our protocol where search costs are low and there are only two possible outcomes. As such, we opted to use a token weighted vote but with some core modifications to reduce voter apathy and cartel formation:

- In order to vote, you have to opt-in to voting with tokens. These tokens are eligible to be slashed if either you vote with the minority or fail to vote. We believe this will help significantly with voter apathy.

- We use a stake redistribution mechanism inspired by Truthcoin to discourage cartel formation.

- Penalties are not a “closed system”. By voting with the minority, you also forfeit a proportionate amount of the transaction fee pool. Since the fee pool goes to the committee in each term, this further incentivizes a higher percentage of outstanding token holders to join the committee.

Collateralization

Like other decentralized finance protocols, CDx plans to initially deal with counterparty risk by initially requiring swap sellers to fully collateralize positions. This means that a participant selling 100 ETH of swap notional has to post 100 ETH of collateral in order to receive the premium. This locked up collateral guarantees full payment for the buyer in the case of a credit event, thereby eliminating any swap seller counterparty risk.

However, full collateralization significantly reduces swap seller profitability because it is highly capital intensive. Therefore, we have designed a system based on the concept of rehypothecation to enable swap sellers to under-collateralize positions while still guaranteeing that swap buyers are protected. We outline five broad rules we put in place:

- The denomination of the re-pledged collateral claims must be identical to the collateral of the new position. This is necessary to prevent mismatches between collateral types.

- The expiry date of the rehypothecated collateral should be equal to or after the expiry date of the positions it is being pledged against. This is necessary to prevent expiration time mismatches.

- There should be a minimum base collateralization level. This is optional, and simply a guideline to be conservative.

- Counterparties should only be able to re-pledge collateral once. This is necessary to prevent “double-dipping” of collateral.

- Counterparties should over-collateralize any positions that use rehypothecated collateral to adjust for the “lower quality” of this collateral. Rather than a set ratio, positions should be collateralized with a diversified pool of collateral claims.